Oakmount - Toronto, Ontario

An exciting & unique opportunity to invest in an 9-unit rental.

The Opportunity

A rare opportunity to add a brand new, 8 unit apartment building to your portfolio in the city of Toronto. The property was recently completed and is fully occupied and cash flowing.

These "missing middle" developments are highly sought after due to the rental shortages that have been plaguing the city for years.

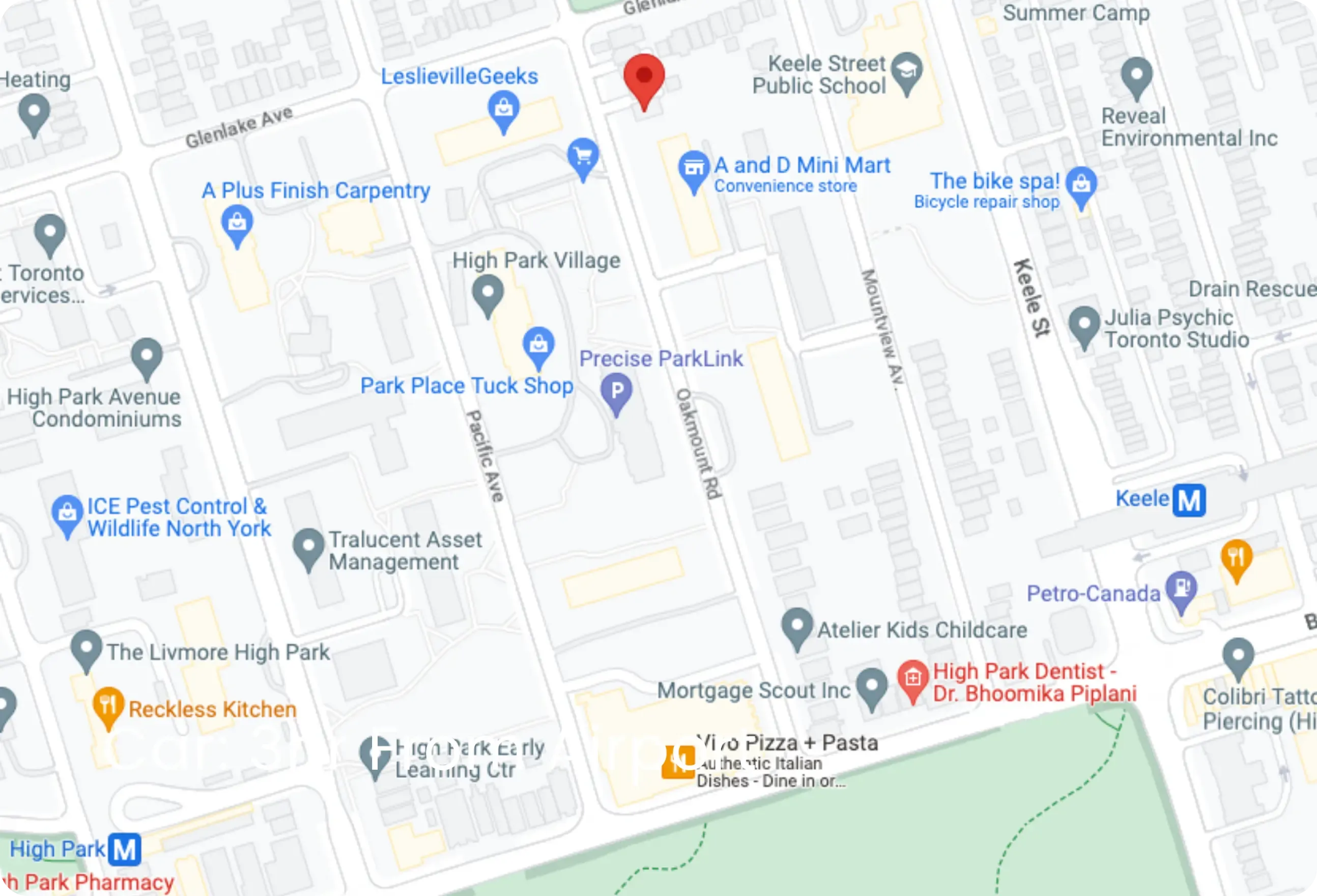

The Location

This property is located just North of Bloor and West of Keele. Access to one of the most desirable parks in all of Toronto (High Park) is at the end of Oakmount. Keele and High Park Subway stations are within 500 meters of the property.

This site is has great walkability with access to restaurants, bars, cafes, banks and grocery stores.

The asset

8 Unit

Purpose Built Rental

Unit Mix

6 x 2 Bed, 2 Bath Units

2 x 2 Bed, 1 Bath Units

7 Car Parking

No Rent Control

Built after 2018

Additional Units

1,000 sq ft - 2 Storey Garden Suite

Valuation

$6,200,000 - As Is

$7,700,000 - As Complete with Garden Suite

CMHC MLI Standard

$3,595,387 - Loan Value

3.93 % Interest

10 Year Term

40 Year Amortization

63% Loan to Value

Exit Options

Sell and Exit

Sell Individual LP Units

Refinance

The investment

Capital Raise

$ 1,600,000

Minimum Investment

$ 30,000 (Registered Fund Eligible)

Projected Return

15 % Annually

Investment Type

Equity Partnership

Length of Investment

3.5 Years

Deal Structure

GP/LP

Project Costs / Loans & Equity

Purchase Price |

$2,750,000 |

Closing Costs |

$250,000 |

Construction Hard Costs |

$1,800,000 |

Construction Soft Costs |

$550,000 |

Carrying Costs |

$650,000 |

Additional Financing Fees |

$200,000 |

Total Project Cost |

$6,200,000 |

CMHC MLI Standard Loan |

$3,600,000 |

Original Investor Capital |

$1,000,000 |

Additional Investor Capital |

$1,600,000 |

Total Loans & Investor Capital |

$6,200,000 |

Operating Revenue / Expenses

8 Units

Gross Yearly Income (minus vacancy)2 Beds (Bsmt) @ $1870, 2 Beds @ $3255 |

$275,051 |

Operating Expenses |

$60,872 |

Net Operating Income |

$214,179 |

Current Valuation (3.5% Cap Rate) |

$6,200,000 |

Net Operating Income |

$214,179 |

Debt Service @ 3.93% Interest |

$179,012 |

Cash Flow |

$35,167 |

Gross Yearly Income (minus vacancy)2 Beds @ $1870, 2 Beds @ $3255, GS @ $3800 |

$325,851 |

Operating Expenses |

$68,682 |

Net Operating Income |

$257,169 |

Projected Valuation (3.5% Cap Rate) |

$7,347,692 |

Net Operating Income |

$257,169 |

Debt Service @ 3.93% Interest + GS Loan |

$194,013 |

Projected Cash Flow |

$63,157 |

Capital Raise

$1,600,000

Ownership Share - 55.8%

Cash Flow Share - 61.9%

Total Cummulative Cash Flow AT YEAR 3.5 $8,758

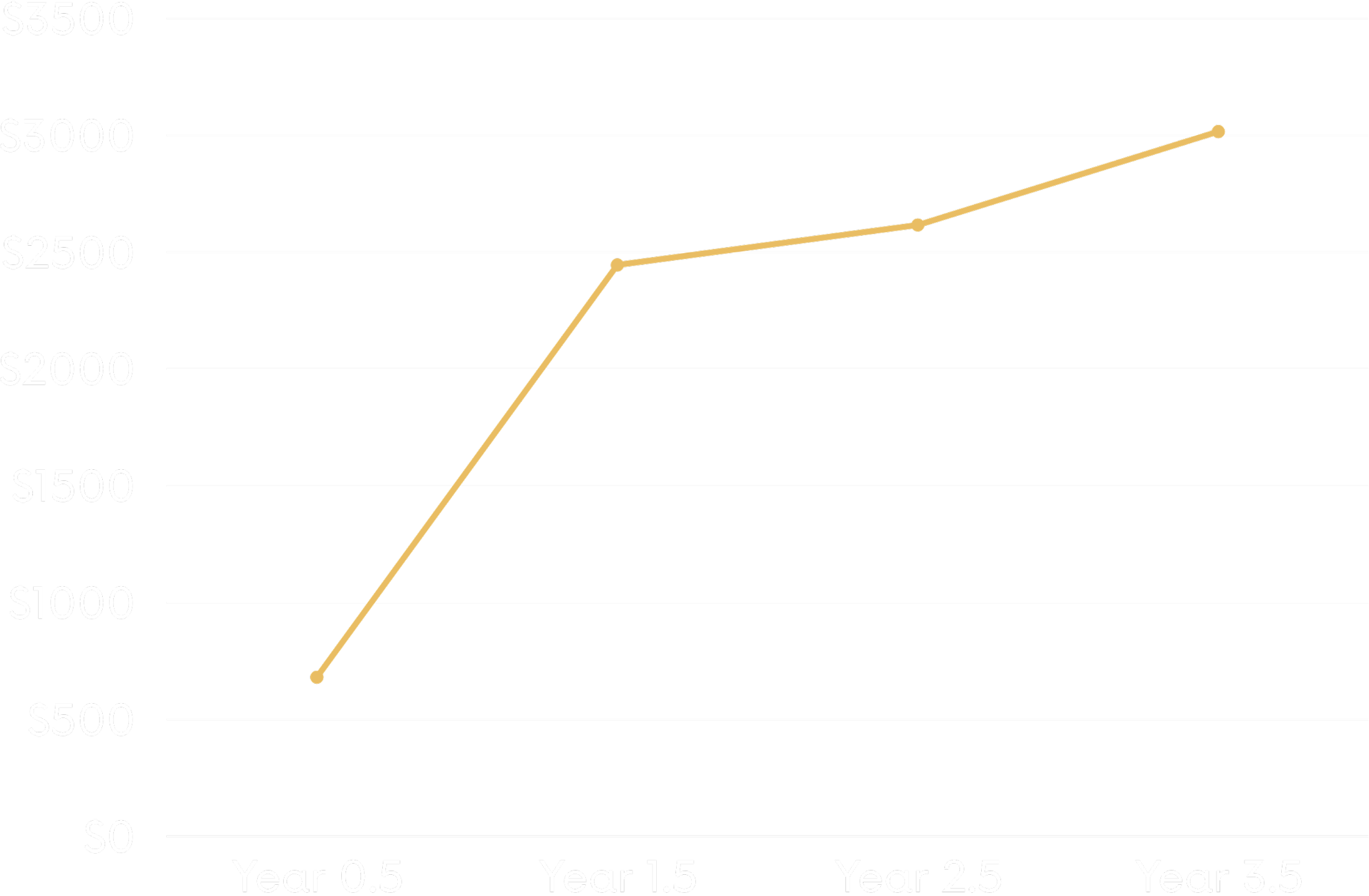

Cash flow Timeline

Per $100,000 Investment

Financial Projections

3.5 Year Projections

Value @ Year 5 |

$8,026,194 |

Mortgage @ Year 5 |

-$3,412,272 |

Selling Costs (5%) |

-$401,310 |

Gross Profit |

$4,212,612 |

Garden Suite Loan |

-$300,000 |

Original Class B Investors |

-$914,167 |

New Class B Investors |

-$1,488,101 |

Net Profit |

$1,510,343 |

New Class B Profit (55.8%) |

$842,696 |

New Class B Investment |

$1,600,000 |

New Class B Profit % |

52.7% |

New Class B % Ann. (3.5yr) |

15% |

Income Growth Rate |

3.5% |

Expense Growth Rate |

1.5% |

Vacancy Rate |

1.5% |

Current Debt Coverage |

1.2 |

Debt Coverage @ Year 5 |

1.57 |

Current Cap Rate |

3.5% |

Future Cap Rate |

3.5% |

Join the Investor Circle

Gain exclusive access to curated real estate development projects, priority investment opportunities, and insights from experienced professionals. Secure your place among a select group of accredited investors.